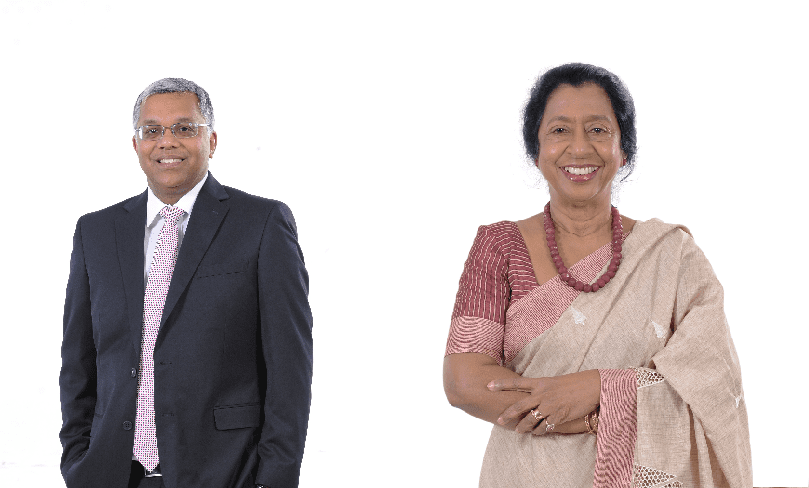

HNB Assurance PLC (HNBA) and its fully owned subsidiary HNB General Insurance Limited (HNBGI) delivered a strong start for 2019, posting a Profit After Tax (PAT) of LKR 119 MN being in line with the business and profit forecast. In reviewing its performance, the Group recorded a Gross Written Premium (GWP) of LKR 2.5 BN against a GWP of LKR 2.2 BN recorded in 2018, depicting a growth of 14%. Sharing her views on the financial performance, Chairperson of HNBA and HNBGI Mrs. Rose Cooray stated “HNBA showcased a promising start for 2019 in topline growth and, despite the challenging external environment, steady improvement in the profitability of the group. Profits of Life Insurance segments grew by 10% excluding one-off items recorded the previous year, while the profitability of General Insurance segment grew by 11% compared to the same period of 2018. The Group is confident that they will be able to maintain this profits momentum and deliver attractive returns to the shareholders. The Group has also crafted for itself more ambitious strategies for the year for the Life and General Insurance businesses and the Group remains well focused on expanding its operations, accelerating innovative technologies and improving execution to create a meaningful difference”. Expressing his views, Managing Director/CEO of HNBA and HNBGI Mr. Deepthi Lokuarachchi stated, “we got off to a positive start in 2019 and our teams have delivered affirmative results during the first quarter despite many challenging conditions. Collective efforts were made to deliver on our long term goals as well as to create value for all stakeholders”. Sharing his views on the financial performance, Mr. Lokuarachchi added, “the Life Insurance business showcased a steady and stable growth momentum, well over the consolidated growth achieved by the Life Insurance sector. Segments such as Motor and Fire of the General Insurance business depicted notable results amidst a challenging environment”. He further stated, “total assets of the Group surpassed LKR 23 BN and the investments in financial instruments reached a value of LKR 18.6 BN. The Life and General Insurance Funds reached values of LKR 12.8 BN and LKR 2.7 BN respectively. The Group is well positioned in its differentiated portfolios and the Management remains confident of the Group’s future outlook in seizing new opportunities and expanding its footprint”. HNB Assurance PLC (HNBA) is the one of the fastest growing Insurance Companies in Sri Lanka with a network of 59 branches. HNBA is a Life Insurance company with a rating of A (lka) by Fitch Ratings Lanka for “National Insurer Financial Strength Rating”. Following the introduction of the segregation rules by the Insurer Regulator, HNB General Insurance Limited (HNBGI) was created and commenced its operations in January 2015; HNBGI continues to specialize in motor, non-motor and Takaful insurance solutions and is a fully owned subsidiary of HNB Assurance PLC. HNBA is rated within the Top 100 Brands and Top 100 companies in Sri Lanka by LMD and HNB Assurance has won international awards for Brand Excellence, Digital Marketing and HR Excellence and also won many awards for its Annual Reports at the Award ceremonies organized by the Institute of Chartered Accountants of Sri Lanka and SAFA (South Asian Federation Accountants).

Dec

HNB Assurance PLC partnered with the Kandy Kings as the Official Protection Partner for the upcoming Colombo Golf League, taking place from 05th to 07th December at the Royal Colombo Golf Club.Through this partnership HNB Assurance extends an insurance cover to the 15-member Kandy Kings squad, ensuring their wellbeing throughout the tournament. As a brand rooted in trust and protection, HNB Assurance is proud to stand behind a team that embodies passion and excellence.Expressing his thoughts on the partnership, Executive Director / CEO of HNB Assurance, Mr. Lasitha Wimalaratne, stated, “We are truly pleased to partner with the Kandy Kings for this year’s Colombo Golf League. Our thanks go out to the franchise for choosing HNB Assurance as their protection partner and placing their confidence in us. As the team prepares to take on this exciting challenge, we are proud to safeguard their 15 players and wish them the very best on the greens.”Sharing his thoughts, Chief Business Officer / GM - Partnerships of HNB Assurance, Mr. Sanesh Fernando, added, “Supporting local sporting talent is a privilege for us. We extend our appreciation to the Kandy Kings franchise for this opportunity and look forward to backing the team throughout the league. We wish the players success, strength, and a memorable performance in this year’s tournament.”

Read More

Nov

HNB Assurance PLC (HNBA) was recently recognized as the winner of the Best Well-being Initiative for Working Parents at the Parent-Inclusive Workplace Summit 2025 hosted by Parenthood Global. This recognition, earned through an independent evaluation among multiple organizations, stands as a testament to HNBA’s commitment to support working parents.For HNBA, this award is a validation of years of intentional effort, focused policies and a culture built on empathy. From caregiver leave to flexible support ecosystems, from in.she initiatives to mom-inclusive programs, HNBA has consistently placed the well-being of working parents at the center of its people agenda. Sharing his thoughts, the Executive Director / Chief Executive Officer of HNB Assurance PLC, Lasitha Wimalaratne, stated “This award is deeply personal to us and my sincere thanks to Parenthood Global for this wonderful recognition. Our commitment has always been to build a company where people feel supported not only as professionals, but as human beings with families, responsibilities and dreams. This recognition is proof that compassion, when embedded into culture, creates a lasting impact.”Navin Rupasinghe, Head of Human Resources / DGM of HNB Assurance PLC, added, “Every HR policy we design and every initiative we introduce is rooted in one belief, that our people deserve a workplace that honors their whole life, not just their job titles. Working parents give so much of themselves every day, and it is our duty and privilege to create an environment that lifts them. I certainly believe that this award belongs to our incredible parents who inspire us to do better, every single day.”

Read More

Nov

HNB Assurance PLC continues to reinforce its commitment to uplifting communities across Sri Lanka through its three core CSR pillars, Health Protection, Environmental Protection and Education Protection. Anchored on these pillars, the company has rolled out a series of impactful initiatives aimed at enhancing wellbeing, improving access to essential resources, and supporting the next generation.Most recently, under the Health Protection Pillar, HNB Assurance supported P/ Wijayapura Primary School, Bisobandaragama Primary School, Mahaweli Primary School and Kidalagema Primary School in Medawachchiya by installing Reverse Osmosis (RO) water filtering systems. These systems provide access to clean and safe drinking water, helping protect schoolchildren from consuming contaminated water and ensuring healthier learning environments. With the completion of these four water projects in 2025, HNB Assurance has now completed over 75 water projects across the country.In addition to these efforts, HNB Assurance continues to champion several long-term development programs. The company conducts pregnant mother programs that promote maternal wellbeing, Grade 05 scholarship programs that encourage academic excellence among young learners and financial literacy programs designed to empower communities with essential money management skills.Through these ongoing initiatives, HNB Assurance remains dedicated to protecting lives, nurturing growth and supporting resilient, thriving communities across the country.

Read More