HNB Assurance PLC Group delivered a robust performance during 1Q22, recording a Profit After Tax (PAT) of LKR 235 Mn, reflecting an impressive growth of 144%, compared to the PAT of LKR 96 Mn recorded during the corresponding period of 2021. The Group recorded a Gross Written Premium (GWP) of LKR 4.3 Bn depicting a notable growth of 33%.

Sharing her views on the Group’s financial performance, Chairperson of HNB Assurance PLC (HNBA) and its fully owned subsidiary, HNB General Insurance Limited (HNBGI), Mrs. Rose Cooray stated, “In spite of several macro-economic challenges prevailing in the market, HNBA and HNBGI delivered an outstanding performance during the first quarter of the year. Both HNBA and HNBGI held a firm stand in delivering these stellar results which contributed to the topline and profitability growth of the Group. These results demonstrate our customer-centric and well-curated business strategies in capturing markets with growth potential. The Life Insurance business recorded a GWP of LKR 2.3 Bn and the General Insurance business recorded a GWP of LKR 1.9 Bn, showcasing an impressive growth of 41% and 24% respectively. Other Revenue of the Group surpassed LKR 1 Bn during 1Q22 marking a 30% growth. During the period, Total Assets of the Group surpassed LKR 37 Bn and Financial Investments surpassed Rs. 30 Bn. The Investment Income of the Group for the period was LKR 938 Mn with an outstanding growth of 40% compared to corresponding period of the previous year and continued to maintain an investment portfolio with healthy credit quality. The Group remains well focused on its clear motive to explore and capture new markets by providing an innovative and a superlative customer experience while maxing shareholder returns”.

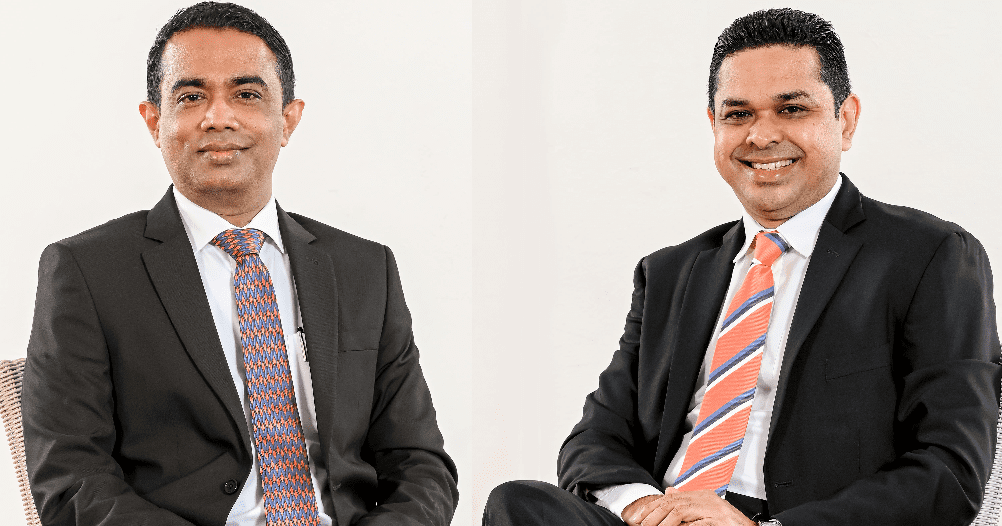

Mr. Lasitha Wimalaratne, Chief Executive Officer of HNB Assurance PLC expressed his views stating, “HNBA concluded another successful quarter showcasing a steady and stable growth momentum, amidst increasing challenges in the external environment. During 1Q22 HNBA recorded a GWP of LKR 2.3 Bn, showcasing a stellar growth of 41%. During the period, the Life Insurance fund reached LKR 21.4 Bn. The Capital Adequacy Ratio (CAR) of HNBA during 1Q22 stood at 281%. This further reaffirms the Company’s financial stability as CAR is well above the minimum stipulated rate of 120% as directed by the Regulator. Owing to our promise, HNBA settled Insurance Benefits and Claims amounting to LKR 527 Mn”. Mr. Wimalaratne added, “These results are a testament to our well-focused strategies and collective efforts of all teams. Backed by an A+ (lka) rating for National Insurance Financial Strength by Fitch Ratings Lanka, the Management of HNBA remains confident of its competitive advantage and strong financial footing and is focused on what’s ahead and seizing every opportunity to expand its footprint in the market”.

Expressing his views, Chief Executive Officer of HNBGI, Mr. Sithumina Jayasundara stated, “During a challenging period for the entire insurance industry, HNBGI was able to deliver steady financial results capitalizing on its service and operational excellence. Surpassing the industry growth rates, HNBGI recorded a GWP of LKR 1.9 Bn showcasing an impressive growth of 24% during 1Q22. The Company continued to deploy its agile business strategies despite the on-going economic challenges and was able to seize several growth opportunities. The Miscellaneous and Motor Insurance segments delivered a notable performance followed by Fire and Engineering segments. During the period, the Company settled Insurance Benefits and Claims amounting to over LKR 830 Mn showcasing our steady commitment to our customers. Demonstrating the Company’s strong financial footing, the Capital Adequacy Ratio (CAR) of HNBGI stood at 247%, well above the regulatory requirement. The General Insurance Contract Liabilities surpassed LKR 4.2 Bn.” Mr. Jayasundara further stated, “As one of the two Fitch Rated General Insurers in the country with an A+ (lka) rating for ‘National Insurer Financial Strength’, HNBGI will continue to steer its course through many challenges to further consolidate its footprint in the market whilst sustaining our core business model and delivering value to all stakeholders”.

HNB Assurance PLC (HNBA) is one of the fastest growing Insurance Companies in Sri Lanka with a network of 64 branches. HNBA is a Life Insurance company with a rating of ‘A+’ (lka) by Fitch Ratings Lanka for 'National Insurer Financial Strength Rating'. Following the introduction of the segregation rules by the Insurance Regulator, HNB General Insurance Limited (HNBGI) was created and commenced its operations in January 2015; HNBGI continues to specialize in motor, non-motor and Takaful insurance solutions and is a fully owned subsidiary of HNB Assurance PLC. HNB General Insurance has been assigned a 'National Insurer Financial Strength Rating' of ‘A+’ (lka) by Fitch Ratings Lanka Limited. HNBA and HNBGI are rated within the Top 100 brands and Top 100 companies in Sri Lanka by LMD and HNB Assurance has won international awards for Brand Excellence, Digital Marketing and HR Excellence including the Great Place To Work® Certification. HNB Assurance was awarded the Best Bancassurance Service Provider in Sri Lanka by Global Banking and Finance Review and has won many awards for its Annual Reports at award ceremonies organized by the Institute of Chartered Accountants of Sri Lanka.

Nov

HNB Assurance PLC (HNBA) was recently recognized as the winner of the Best Well-being Initiative for Working Parents at the Parent-Inclusive Workplace Summit 2025 hosted by Parenthood Global. This recognition, earned through an independent evaluation among multiple organizations, stands as a testament to HNBA’s commitment to support working parents.For HNBA, this award is a validation of years of intentional effort, focused policies and a culture built on empathy. From caregiver leave to flexible support ecosystems, from in.she initiatives to mom-inclusive programs, HNBA has consistently placed the well-being of working parents at the center of its people agenda. Sharing his thoughts, the Executive Director / Chief Executive Officer of HNB Assurance PLC, Lasitha Wimalaratne, stated “This award is deeply personal to us and my sincere thanks to Parenthood Global for this wonderful recognition. Our commitment has always been to build a company where people feel supported not only as professionals, but as human beings with families, responsibilities and dreams. This recognition is proof that compassion, when embedded into culture, creates a lasting impact.”Navin Rupasinghe, Head of Human Resources / DGM of HNB Assurance PLC, added, “Every HR policy we design and every initiative we introduce is rooted in one belief, that our people deserve a workplace that honors their whole life, not just their job titles. Working parents give so much of themselves every day, and it is our duty and privilege to create an environment that lifts them. I certainly believe that this award belongs to our incredible parents who inspire us to do better, every single day.”

Read More

Nov

HNB Assurance PLC continues to reinforce its commitment to uplifting communities across Sri Lanka through its three core CSR pillars, Health Protection, Environmental Protection and Education Protection. Anchored on these pillars, the company has rolled out a series of impactful initiatives aimed at enhancing wellbeing, improving access to essential resources, and supporting the next generation.Most recently, under the Health Protection Pillar, HNB Assurance supported P/ Wijayapura Primary School, Bisobandaragama Primary School, Mahaweli Primary School and Kidalagema Primary School in Medawachchiya by installing Reverse Osmosis (RO) water filtering systems. These systems provide access to clean and safe drinking water, helping protect schoolchildren from consuming contaminated water and ensuring healthier learning environments. With the completion of these four water projects in 2025, HNB Assurance has now completed over 75 water projects across the country.In addition to these efforts, HNB Assurance continues to champion several long-term development programs. The company conducts pregnant mother programs that promote maternal wellbeing, Grade 05 scholarship programs that encourage academic excellence among young learners and financial literacy programs designed to empower communities with essential money management skills.Through these ongoing initiatives, HNB Assurance remains dedicated to protecting lives, nurturing growth and supporting resilient, thriving communities across the country.

Read More

Nov

HNB Assurance PLC has entered into a strategic partnership with Dialog Finance PLC, a pioneer in digital financial solutions, to further enhance its digital payment infrastructure and accelerate its journey towards achieving 100% digital premium collection.This collaboration marks a significant milestone in HNB Assurance’s digital transformation journey, reflecting the company’s continuous commitment to improving customer convenience, operational efficiency and financial inclusivity. By integrating Dialog Finance’s advanced Genie Business platform, which includes Payment Links and Internet Payment Gateway (IPG) services, HNB Assurance aims to streamline its premium collection process and redefine how customers interact with insurance services.Through these solutions, customers will now be able to make payments effortlessly and securely, either through personalized payment links shared by HNB Assurance or via secure online gateways. This eliminates the need for manual or in-person transactions, ensuring instant payment acknowledgments, and offers customers a faster, safer, and more convenient experience.This partnership leveraging innovation and technology not only strengthens the technological backbone of HNB Assurance’s payment ecosystem but also align with the company’s long-term vision of becoming a fully digital insurer, offering end-to-end solutions that meet the evolving needs of modern customers.

Read More