Jul

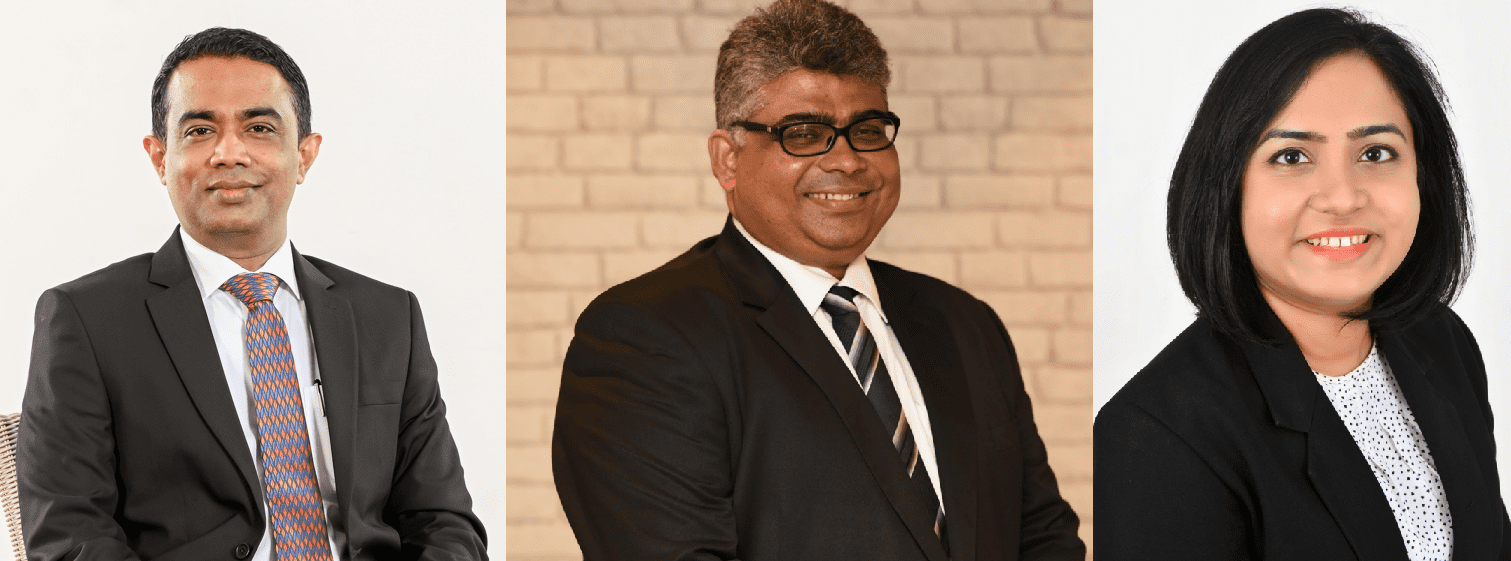

HNB Assurance PLC (HNBA) recently entered into a Memorandum of Understanding (MoU) with DOK Solutions Lanka (Pvt) Limited (DOK), a leading record management and business process management company in the country. The MoU was signed by Mr. Lasitha Wimalaratne, Chief Executive Officer of HNBA and Mr. Phiroze Pestonjee, Managing Director of DOK. This partnership will provide HNBA a hassle-free insurance policy management mechanism with high service and information security standards, ensuring overall operational cost reduction through outsourcing.

Sharing his views on the partnership, Chief Executive Officer of HNBA, Mr. Lasitha Wimalaratne stated, “HNBA is thrilled to join hands with DOK with the sole objective of enhancing our operational and service excellence. An effective policy management mechanism is key to providing an uninterrupted service at all times. Accordingly, DOK will provide end-to-end policy management solutions by customizing policies based on needs, printing of policy documents and preparation and handing over for delivery. This offsite process management solution will reduce the Company’s operational cost and the solutions offered by DOK will guarantee high levels of efficiency and will further improve the levels of service delivery of the Company”.

Mrs. Prabodhanie Wanigasundara, Chief Operating Officer of DOK expressed her views stating, “It’s a privilege for us to partner with a reputed servicer provider such as HNB Assurance, a company which always display customer centricity. We are happy to deliver the promise of HNB Assurance to their valued customers by offering a more simplified and customized policy to the end customer within the shortest possible time”.

HNB Assurance PLC (HNBA) is a leading Life Insurance company in Sri Lanka with a network of 64 branches. HNBA is a Life Insurance company with a rating of ‘A+’ (lka) by Fitch Ratings Lanka for 'National Insurer Financial Strength Rating'. Following the introduction of the segregation rules by the Insurance Regulator, HNB General Insurance Limited (HNBGI) was created and commenced its operations in January 2015; HNBGI continues to specialize in motor, non-motor and Takaful insurance solutions and is a fully owned subsidiary of HNB Assurance PLC. HNB General Insurance has been assigned a 'National Insurer Financial Strength Rating' of ‘A+’ (lka) by Fitch Ratings Lanka Limited. HNBA is rated within the Top 100 brands and Top 100 companies in Sri Lanka by LMD and HNB Assurance has won international awards for Brand Excellence, Digital Marketing and HR Excellence including the Great Place To Work® Certification, and won many awards for its Annual Reports at award ceremonies organized by the Institute of Chartered Accountants of Sri Lanka.

Established in 2010, DOK Solutions offers a wide range of document management services including physical archiving, document digitizing / scanning, data capturing, document management solutions, insurance policy management and other business process management services to public and private sector institutes in Sri Lanka. DOK Solutions is accredited with ISO 27001, ISO 9001 and 45001.DOK Solutions got recognized as one of the 10 best places to work, under the IT/ITES category in Sri Lanka by Great Place to Work® 2022 awards. During its decade of operations, the company gradually expanded its service portfolio and customer base, achieving a steady revenue growth with a CAGR of 21 percent. The company serves a wide range of customers including leading banks, insurance companies, finance companies, private hospitals, educational institutes, manufacturing companies, retail sector and other corporate establishments.

Jul

HNB Assurance PLC (HNBA) recently partnered with AETINS-KGiSL, a leader in innovation and information technology in order to upgrade its core system. The agreement was signed by Mr. Lasitha Wimalaratne, Chief Executive Officer of HNBA and Ms. Saraswathy Sarangapany, Vice President, Insurance Practice of KGiSL in the presence of Mrs. Rose Cooray, Chairperson of HNBA and its fully owned subsidiary, HNB General Insurance Limited (HNBGI), Mr. Dilshan Rodrigo, Non-Independent/Non-Executive Director of HNBA, Dr. Prasad Samarasinghe, Alternate Director - Non-Independent/Non-Executive Director of HNBA and HNBGI, Mr. Suneth Jayamanne, Chief Information Officer of HNBA & HNBGI and Mr. Ravindra Mohan, Director, Insurance Solutions and Consulting of KGiSL.

Expressing her views, Mrs. Cooray stated, “In today’s context information technology and every component associated has become vital for the survival of business ventures across the globe and the success of businesses highly rely on efficient processes and systems to cope up with demands and challenges in the market. This partnership reflects on our vision to transform HNBA into an even more progressive, dynamic, and innovative business. A system of this nature combined with the core competencies, expertise and knowledge of a vibrant and energetic team will lead HNBA in the right direction to build a legacy of its own”.

Mr. Lasitha Wimalaratne, Chief Executive Officer of HNBA stated, “Innovation and technology go hand in hand and if we are to digitally disrupt the market we should be fully geared with the latest technology, systems and processes and this partnership will enable us to gain access to a more efficient core business system. The new system will help us rethink and reengineer the core pillars of the business to achieve agility in everything that we do and say and thereby enabling seamless integration between the superlative experience that we provide to our customers and core business system”.

Speaking on the new core system, Chief Information Officer of HNBA and HNBGI, Mr. Suneth Jayamanne stated, “HNBA embarked on a journey to completely transform its processes and systems and this is a key milestone in the journey. This system will continue to enhance flexibility, efficiency, performance and digital capabilities within the organization and its value chain. The team at HNBA is excited to partner up with a leader in this sphere and look forward to combining strengths and sharing synergies”.

Ms. Saraswathy Sarangapany, Vice President, Insurance Practice of KGiSL shared her views stating, “We are indeed thrilled to join hands with HNB Assurance, a leader in the life insurance market in Sri Lanka. This partnership will surely help HNBA to reshape and set new benchmarks in the industry. This core system will provide accurate and timely information and calculations whilst increasing efficiency and productivity of employees at the same time reducing the scope for errors. It also provides 360-degree insight of customers for more upselling and cross selling and enhances meaningful engagement with customers as business agility is instrumental in taking any entity to the next level. The new core system will be implemented within a short span of time, and we are confident that this system will help HNBA and its teams to optimize and improve level of efficiency and to keep pace with ever-changing technology”.

HNB Assurance PLC (HNBA) is a leading Life Insurance Company in Sri Lanka with a network of 64 branches. HNBA is a Life Insurance company with a rating of ‘A+’ (lka) by Fitch Ratings Lanka for 'National Insurer Financial Strength Rating'. Following the introduction of the segregation rules by the Insurance Regulator, HNB General Insurance Limited (HNBGI) was created and commenced its operations in January 2015; HNBGI continues to specialize in motor, non-motor and Takaful insurance solutions and is a fully owned subsidiary of HNB Assurance PLC. HNB General Insurance has been assigned a 'National Insurer Financial Strength Rating' of ‘A+’ (lka) by Fitch Ratings Lanka Limited. HNBA is rated within the Top 100 brands and Top 100 companies in Sri Lanka by LMD and HNB Assurance has won international awards for Brand Excellence, Digital Marketing and HR Excellence including the Great Place To Work® Certification, and won many awards for its Annual Reports at award ceremonies organized by the Institute of Chartered Accountants of Sri Lanka.

KGiSL is a BFSI centric multiproduct Enterprise Software company focused on Banking, Insurance, Capital Markets, & Wealth Management segments. KGiSL by roots believe in being empathetic to customers and offering products and services that delivers business outcome.

Jun

As the country is navigating a challenging recovery, with much uncertainty and limitations ahead, HNB Assurance PLC (HNBA) has introduced multi-channel communication platforms for its customers enhancing ease, convenience, and efficiency to obtain information about the products of the Company, information pertaining to their policies or any inquiries or complaints without visiting a branch. Customers could now reach HNBA by dialing its hotline on 1301 or for text-based communication on 0766 384 384 via WhatsApp or info@hnbassurance.com via email or through its social media channels. Customer Experience is a core pillar of the Company’s strategy and HNBA, as a leading life insurance service provider in the country has introduced a number of initiatives to provide a superlative experience to its customers. Sharing his views Mr. Lasitha Wimalaratne, Chief Executive Officer of HNBA stated, “Customer Experience is a journey, and the values of the brand are resonated through the service we provide to our customers at every moment and every touchpoint. The right customer experience strategy provides a seamless and consistently excellent experience across all channels and HNBA continuously strives to create an unmatched, superlative customer experience. The Company follows a simple yet effective Customer Experience mantra; that is every customer is unique and every customer has a different need. The key to providing a superlative service is by truly understating the customer beyond the words spoken. In a highly competitive market such as insurance, the right customer experience strategy can make a real difference and I’m extremely happy about HNBA’s Customer Experience Team and their efforts”. Chief Marketing and Customer Experience Officer/General Manager of HNBA and its fully owned subsidiary HNB General Insurance Limited, Mr. Dinesh Yogaratnam express his views stating, “Today’s customer is extremely discerning in terms of what they expect from organisation that they transact with, whilst the importance of the right fit in terms of product goes unsaid, a well curated customer experience strategy which is meticulously implemented can help businesses to differentiate themselves and create that real difference which is felt by the customer. Simply put, Customer Experience in today’s context is the game changer. Customers seek seamless, consistently excellent solutions across all channels and with the intention of providing a world-class customer experience, HNBA has introduced several initiatives. The Company has infused and will continue to infuse better technology capabilities as the backbone along with enhanced data capabilities as a conduit through which a superior service delivery would be facilitated. The Company has also commenced various initiatives to inculcate a Customer First Ethos amongst its staff who would be the ultimate purveyor of our services. As a brand which focuses on being attuned with the environment within which we operate, HNBA has constantly challenged the traditional business model and has adapted innovative ways to attract, win and retain its customers and will continue to set new benchmarks in terms of providing a superlative customer experience”. Speaking on the multi-communication platforms, Head of Customer Experience/Assistant General Manager of HNBA, Mrs. Shaazna Ossen stated, “HNBA has taken several initiatives to provide an exceptional service by introducing multi-communication platforms, including an easy-to-remember short code number which customers could dial from any network to get in touch with us. Moreover, the Company has a designated Complaints Management Unit to resolve complaints in an efficient manner. These communication channels will be a pivotal steppingstone for us in fostering our relationships with customers especially during these challenging times. The Complaints Management Team has been provided direct access to the Senior Management of HNBA so that every customer complaint is resolved in an efficient manner. The Customer Experience standards of the Company is on par with industry standards and the performance of the Customer Experience team is constantly monitored to ensure that standards are maintained at every level. The Company has taken a number of initiatives to uplift, motive and empower the Customer Experience team as they are the face of the Company and to ensure a delivery of a superlative service. Customers can directly reach us by dialing 1301 or via WhatsApp, email or through our social media channels and our dedicated Customer Experience Team will assist all our customers with utmost efficiency”. HNB Assurance PLC (HNBA) is a leading Life Insurance Companies in Sri Lanka with a network of 64 branches. HNBA is a Life Insurance company with a rating of ‘A+’ (lka) by Fitch Ratings Lanka for 'National Insurer Financial Strength Rating'. Following the introduction of the segregation rules by the Insurance Regulator, HNB General Insurance Limited (HNBGI) was created and commenced its operations in January 2015; HNBGI continues to specialize in motor, non-motor and Takaful insurance solutions and is a fully owned subsidiary of HNB Assurance PLC. HNB General Insurance has been assigned a 'National Insurer Financial Strength Rating' of ‘A+’ (lka) by Fitch Ratings Lanka Limited. HNBA is rated within the Top 100 brands and Top 100 companies in Sri Lanka by LMD and HNB Assurance has won international awards for Brand Excellence, Digital Marketing and HR Excellence including the Great Place To Work® Certification, and won many awards for its Annual Reports at award ceremonies organized by the Institute of Chartered Accountants of Sri Lanka.